At HDFC Bank, our primary focus has always been our people. The organization harbours a culture of meritocracy to support an environment that nurtures young talent transforming them into the young leaders of tomorrow. Keeping this legacy alive, we present to you the Future Bankers Program, designed to make you future ready!

![]() To equip aspirants with the necessary skillsets to build long term careers in Banking and help build a future ready talent pipeline to achieve the Bank’s objectives.

To equip aspirants with the necessary skillsets to build long term careers in Banking and help build a future ready talent pipeline to achieve the Bank’s objectives.

Application

Form

Assesment

Fee

Online

Assesment

Programme Fees

INR 2.57 Lacs (incl. taxes)

Including (4 months accommodation)

Learn everything you need with :

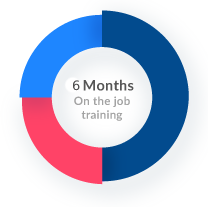

4 months at Manipal

campus, Banglore

2 months Internship at

any HDFC bank branch

6 months On the job

training at any HDFC bank

branch

Get awarded a Post Graduate Diploma

in Sales and Relationship Banking

from Manipal University on

successful completion of the course

Placement Opportunity as a

Personal Banker with HDFC Bank

Earn while you learn!

Out of pocket expenses every

month for 4 months

during the course

Stipend every month

during 2 month internship

and 06 month On the job training

Future Bankers Program -2.0 is a 1 year professional diploma program by HDFC Bank in collaboration with Manipal University, one of India’s leading educational institutions. This program has been structured to provide a “real world” experience to future banking aspirants.

![]()

A 4 month residential on–campus stint which is an exciting mix of:

![]()

For the duration of the program, you are eligible for a stipend as follows:

Not only that, you get paid to learn!

![]()

A 08 month paid Internship+OJT at any of the HDFC Branch locations within the country to further strengthen your grounding in banking products, processes, compliance framework and day-to-day banking operations

![]()

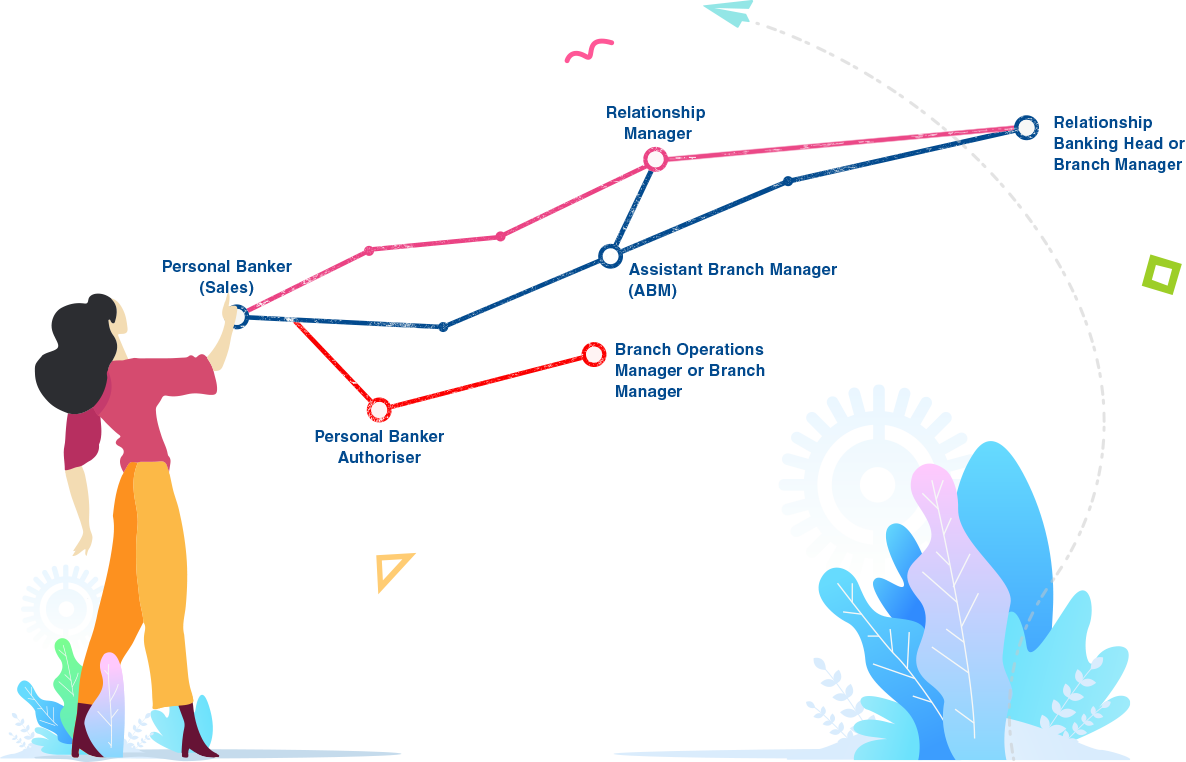

Job Opportunity as a Personal Banker at the grade of Deputy Manager with HDFC bank on successful completion of the course

![]()

A Post Graduate Diploma in Sales & Relationship Banking

“Sales is contingent upon the attitude of the salesman, not the attitude of the prospect.”

-William Clement Stone

The program has been structured to specifically create a pool of first level bankers. It equips aspirants with the skill sets and the knowledge required to step into the real world with utmost confidence.

The placement opportunity of the programme gives young minds an opportunity of accelerated growth and seamless transition into the workforce.

The program concentrates heavily on the more practical aspects of learning making it more professional than other programs in the same category.

This is a once-in-a-lifetime opportunity for individuals to become a part of HDFC bank, one of India’s foremost brands reputed for its rich legacy of innovation, transparency and honesty.

At INR 2.57 lacs (incl. taxes) which includes boarding charges for the first 4 months of on-campus training, the program is immense value for money as compared to other professional courses in the same category.

Course fee refund within 2-3 years

| Future Bankers Program - 2.0 | vs | Other Courses |

|

|---|---|---|---|

|

with knowledge of banking processes & real word experience |

Courses |

with very limited practical application |

|

|

Stipend paid throughout the course |

Financial benefit |

during the course of the program |

|

Less than market

Less than market rates (11.75%) Customized Educational Loans at less than market rates [While there is a customized Education Loan, candidate may avail an Education Loan from any other Financial Institution of their choosing.] |

Education Loans |

Higher Education

Higher Education Loan interest rates & stricter repayment timelines |

HDFC Bank is a young and dynamic bank, with a youthful and enthusiastic team determined to accomplish the vision of becoming a world-class Indian bank. We’d like you to come Join the Winning Team!

Customer

Customer  Operational

Operational  Product

Product  People

People

Sustainability

Sustainability

i

Josh is the Bank’s sporting extravaganza! Initiated in the year 2012 in 8 cities, Josh has now expanded to 29 cities PAN India.

ii

Hunar is the Bank’s in-house talent hunt. Give yourself and your colleagues an opportunity to unwind in the midst of busy work schedules.

iii

Initiated in 2015, Xpressions is a theme based art competition that you can participate in with your families.

iv

The Wanderers initiative helps you get back in touch with nature through monsoon treks, nature trails & adventure sports.

At HDFC Bank, progress isn’t simply about moving with the times. It is about ushering in ‘Parivartan’ - a transformation that improves lives and empowers communities.

We’ve been privileged to enjoy success over the last quarter of a century. But this success would be hollow if we didn’t use our resources to give back to society. This is the founding principle of Parivartan and the cornerstone of our CSR efforts. Today, our commitments in the field have made us one of the largest spenders on CSR in the country. Through our efforts, we have impacted 54 million lives so far.

The Five Pillars of Parivartan

We work with marginalised communities to understand their unique needs, and then formulate customised strategies to bring forth the Parivartan they need.

Our CSR programmes focus on five distinct areas of intervention:

1. Rural Development

The Holistic Rural Development Programme (HRDP) is a flagship programme under rural development. It attempts to provide rural communities, with the tools and means to grow and prosper. HRDP’s various initiatives in areas such as educational infrastructure, healthcare, and natural resources management including micro-watershed management, irrigation, soil and water conservation, represent our attempts to usher in meaningful and impactful change where it matters the most.

Today, HRDP spans across 17 states and has reached over 3.6 lakh households in more than 1,100 villages. We have set up over 1,200 schools, and facilitated better learning opportunities for over 1.45 lakh students. We have also trained over 72,500 farmers, distributed more than 10,800 biomass stoves and set up over 460 libraries.

Other programme highlights include:

2. Promotion of Education

We believe that a quality educational foundation is a gateway to better opportunities and success. This is why we strive to provide and promote a conducive and effective learning environment. The Zero Investment Innovations for Education Initiatives (ZIIEI), is a large scale teacher outreach initiative started in 2015 by HDFC Bank in partnership with Sri Aurobindo Society.

ZIIEI aims to find solutions created by teachers at the grassroots level and systematically scale them up to millions of students through the 'Navachar Pustika' or Book of Ideas, which is a compilation of the best ideas selected and recognized by a panel.

The ZIIEI programme today has touched more than 15 lakh government teachers across 21 states and indirectly reaches out to more than 1.6 crore students to ensure quality education and bring innovation in the country’s education system.

Our Educational Crisis Scholarship Support (ECSS) programme provides support to children undergoing personal and economic exigencies, those who are most at risk of dropping out of school due to poor financial conditions. The ECSS programme covers students in middle schools and high schools, as well as scholars pursuing undergraduate and postgraduate education.

3. Skill Development and Livelihood Enhancement

We at HDFC Bank, have provided training in fields such as communication skills, agriculture techniques, livestock management among others. We hope to expand and diversify this portfolio in the years to come and strengthen our focus on rural youth and women. As of today, we have served over 1.24 lakh individuals and empowered over 7.65 lakh women, helping them access entrepreneurship and employment opportunities.

Sustainable Livelihood Initiative: Empowering women through financial inclusion

Through this initiative we have reached out to over 96 lakh households across 27 states through credit facilities, financial literacy and capacity building programmes. The primary objective of SLI is to bring about Parivartan by creating sustainable communities. This is done by helping women in rural areas break away from the vicious cycle of financial dependence to one of growth and opportunities. Run by over 10,000 dedicated bank employees, it provides women with a range of financial and non-financial services.

4. Healthcare and Hygiene

Under our interventions in healthcare and hygiene we have conducted over 1,500 sanitation drives and have helped build over 22,490 sanitation units of which 6,954 units have been built in schools and 15,537 in individual households. Through our various other initiatives within the programme, such as the ‘Swachhata and You’ campaign, we have dedicated ourselves to community-led sanitation and health campaigns. These campaigns help raise awareness about nutrition, healthcare and hygiene in rural areas, and contribute towards a cleaner, healthier nation. Our health camps have reached out to 86,000 people so far.

5. Financial Literacy and Inclusion

In a world that operates on the exchange of goods and services for money, communities cannot progress and interact with the world at large, without basic financial literacy and inclusion. We understand this, which is why we have taken on the responsibility to spread financial awareness, by running workshops to empower the marginalised sections of society. As on FY 2018-19, the initiative saw more than 8.1 million participants benefit through workshops held at literacy camps and banking outlets.

The flagship project of Digidhan or Dhanchayat has been one of our most fruitful initiatives. This Literacy Programme-on-Wheels takes financial literacy to people who do not have access to regular venues. These vehicles are equipped with micro-ATMs and biometric facilities to enable instant account opening and Know Your Customer (KYC) processes.

Complete

Complete  Pay Assesment Fee

Pay Assesment Fee  Take Online

Take Online